Instant Guide 2025: Withdraw Online Casino Winnings Tax-Free in Just 15 Minutes (Germany)

27.09.2025

Withdrawing Large Amounts from Online Casinos in Germany - The Complete Plan Without Taxes and Delays (2025)

- Minimum: €50

- Per day: up to €5,000

- Per week: up to €10,000

- Per month: up to €20,000

Why Traditional Bank Transfers No Longer Work

Tax Trap

Since January 1, 2025, Germany has tightened control over gambling winnings. Any annual win over €801 is taxed at 26.375%. The tax office receives automatic notifications from banks for transfers > €1,000 and has access to accounts with EU IBAN.

Bank Blocks

Time Loss & Hidden Fees

15-Minute Checklist: Tax-Free Withdrawal - Step by Step

Let's go through each point to protect your winnings from the tax office and bank blocks.

Check License

- Schleswig-Holstein License 2025 - the only one legally allowed to operate in Germany.

- Curacao 8048/JAZ - suitable if the casino uses European payment gateways and pays out to eWallet or crypto.

Choose IBAN-Free Method

- Skrill DE, Neteller DE, MiFinity - money stays in the e-wallet system and doesn't appear on bank statements (available at Spinrise & Verde).

- Binance Pay, Tether TRC-20 - crypto payout in seconds, fee 0-0.5%.

Complete KYC Identity in 5 Minutes

- Video identification via smartphone (passport + selfie).

- ID card via NFC chip (Slotuna, Vulkan Spiele).

Confirm Limits & Fees

- Check daily limit

- Ensure: fee = 0%.

Request Withdrawal & Track Time

- Immediately after confirmation status »Processing« - done.

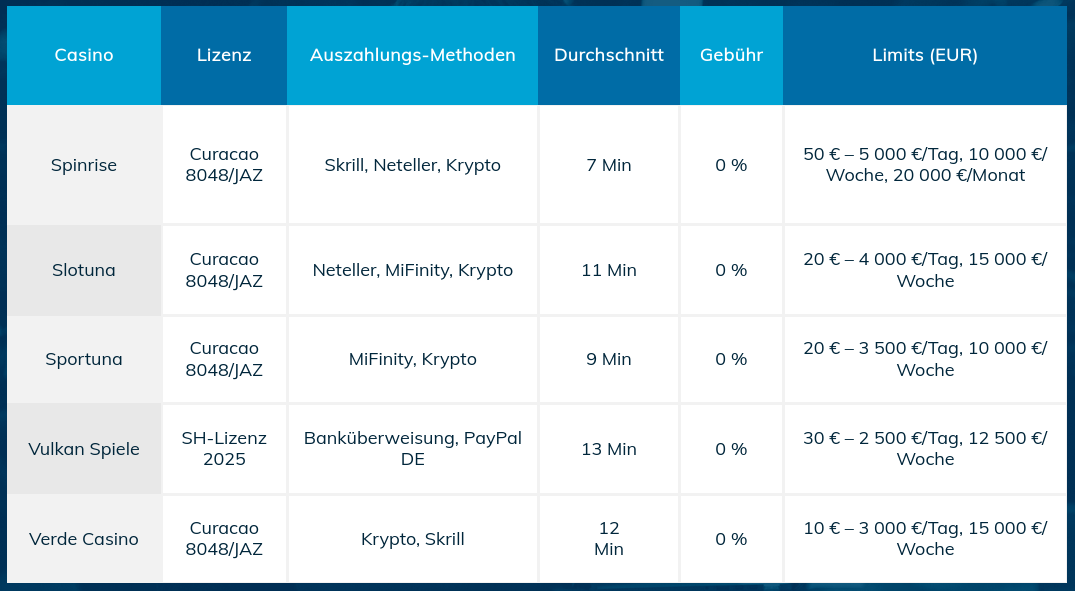

Comparison of the 5 Most Popular Casinos: Payout Time, Limits & Fees

(As of August 2025)

How to Avoid the Tax Trap - 5 Simple Rules

Only play at licensed casinos

Vulkan Spiele - official SH license 2025, payout to German IBAN without blocks.

Spinrise, Slotuna, Sportuna, Verde Casino - Curacao + EU-compliant eWallet gateways (Skrill DE, Neteller DE), therefore transactions don't appear in German bank statements.

Keep annual winnings ≤ €801 or payout in partial amounts

Amounts up to €801 are tax-free (§ 22 No. 3 EStG).

For higher winnings, split the payout to multiple crypto or eWallet addresses and withdraw them in different tax years.

Use cryptocurrency or eWallet without IBAN

Tether (TRC-20), Bitcoin Lightning, Skrill/Neteller - don't appear on bank statements.

Spend directly via eWallet card (e.g., Skrill Card), bypassing the bank account.

Secure screenshots and receipts

Screenshots of "Processing" and "Completed" from the casino cashier prove that the payout went through a licensed provider.

PDF receipts from the eWallet help with potential audits.

Use cool-off for tax year

Once €800 is reached in the current year, activate 24-hour cool-off and withdraw the remaining amount in the new calendar year.

Conclusion

Your winnings are already waiting - you just need to press the right button.

Follow the checklist above, pay no additional tax, and never see "Transaction rejected" again. One account, one eWallet or crypto wallet - and bank blocks become a thing of the past.